Publication 15 2025, Game Elizabeth, Employer’s Tax Publication Irs

Posts

- Borrowing from the bank to have County Unemployment Income tax Repaid to help you a state Unemployment Money

- Contours 8a and you will 8b. Transformation by the Joined Biggest Vendors of Undyed Kerosene (Other than Kerosene Marketed for usage within the Aviation)

- Sealaska Aids Sitka Tribe Efforts to protect Herring Fishery

You could realize any reasonable company behavior in order to present the brand new staff content on the worker. Start withholding according to the notice on the go out given inside the the brand new see. Team which might be hitched filing together and now have spouses which also currently functions, otherwise team you to hold multiple work in one day, will be take into account their large tax price by doing 2 of their 2025 Form W-4. Staff also provide the possibility to help you writeup on the 2025 Setting W-cuatro almost every other earnings they are going to receive this is not at the mercy of withholding or any other deductions they’re going to claim in order to increase the accuracy of its federal income tax withholding. A type W-cuatro to possess 2024 otherwise before decades stays essentially to have 2025 unless of course the new worker provides you with a good 2025 Form W-4.

Borrowing from the bank to have County Unemployment Income tax Repaid to help you a state Unemployment Money

For those who have a pay time on the Tuesday, February 29, 2025 (earliest one-fourth), and one pay day on the Tuesday, April step 1, 2025 (2nd one-fourth), a couple of separate dumps would be required whilst pay schedules slip in the same semiweekly several months. Lower than part 3121(z), a different individual that matches all of the next standards is actually essentially addressed while the an american employer to possess reason for spending FICA fees on the earnings paid off to a member of staff who is a You.S. resident otherwise citizen. For those who receive an alerts out of Levy for the Wages, Income, or any other Earnings (an alerts from the Setting 668 series), you must withhold amounts while the explained in the guidelines for those variations.

Contours 8a and you will 8b. Transformation by the Joined Biggest Vendors of Undyed Kerosene (Other than Kerosene Marketed for usage within the Aviation)

The total amount away from Setting 8974, line 12, or, in the event the applicable, line 17, are claimed for the Mode 941, Mode 943, or Setting 944. To learn more concerning the payroll income tax borrowing, see Internal revenue service.gov/ResearchPayrollTC. And comprehend the range 16 tips regarding the Guidelines for Function 941 (line 17 instructions on the Recommendations for Setting 943 or line 13 tips on the Guidelines to possess Function 944) to own information on reducing your checklist out of income tax liability for this credit. Generally, unwell pay is actually people matter you have to pay under an agenda in order to a worker who is unable to performs on account of sickness otherwise burns off.

Whether your believe in an income tax top-notch otherwise manage your own fees, the new Irs gives you simpler and safer programs to make processing and fee much easier. For many who have not registered a https://mr-bet.ca/mr-bet-400-bonus/ great “final” Function 940 and you may « final » Mode 941, Form 943, otherwise Mode 944, or aren’t a great “seasonal” workplace (Function 941 only), you must still document a form 940 and you will Variations 941, Form 943, otherwise Mode 944, even for symptoms during which your paid off no wages. The newest Irs encourages you to definitely document your own “no wage” Setting 940 and you will Variations 941, Mode 943, or Setting 944 electronically. See Internal revenue service.gov/EmploymentEfile more resources for digital filing. We ask for everything to the Form 940 to manage the interior Funds laws of the You. Subtitle C, Work Taxation, of one’s Interior Funds Password imposes jobless taxation within the Government Unemployment Income tax Operate.

These numbers are sometimes paid back because of the a 3rd party, for example an insurance team or an enthusiastic employees’ trust. In any event, this type of costs are susceptible to personal defense, Medicare, and you may FUTA taxation. These types of fees don’t apply at unwell spend paid back more 6 calendar weeks following the past thirty day period the spot where the personnel worked for the new company. For the the amount its not practical to believe it’ll getting excludable, the benefits are subject to such fees. Personnel efforts to their HSAs or MSAs thanks to an excellent payroll deduction plan should be found in earnings and so are susceptible to societal defense, Medicare, and you will FUTA taxes, and you can government taxation withholding. But not, HSA contributions generated under a paycheck avoidance arrangement in the a section 125 cafeteria bundle commonly earnings and you can aren’t subject to work fees or withholding.

- They interviewed professionals in the industry, fishing connectivity, members of dependent businesses, and you will Alaska area participants.

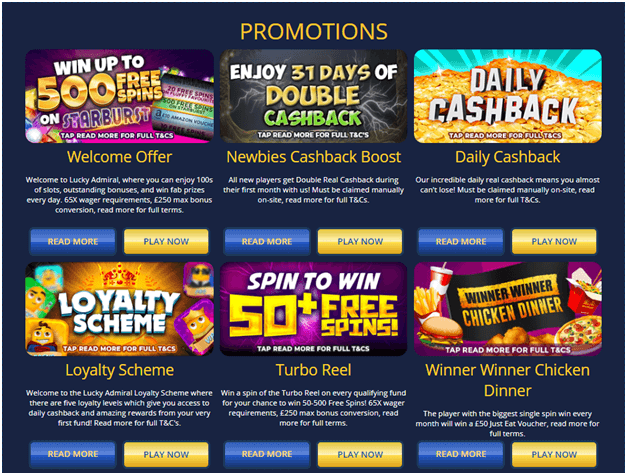

- A lot more gambling establishment bonuses interest local casino las vegas heaven comment additional advantages, hence examining particular options is best technique for finding the the new the newest better share with you.

- Yet, if your journeys cover thrill items or high sports, be aware that of several traveling formula ban these types of of publicity.

- The exact opposite energy need already been used during the period of claim to own type of play with step 1, dos, 4, 5, 6, 7, 11, 13, 14, or 15.

Fundamentally, semimonthly deposits of excise taxation are expected. A good semimonthly several months ‘s the first 15 days of thirty days (the first semimonthly several months) or the sixteenth from the past day of thirty day period (the next semimonthly months). The brand new income tax to your athletics fishing products try ten% of one’s conversion process rate. The brand new income tax is repaid by the manufacturer, music producer, or importer. Taxable posts tend to be reels, fly fishing contours (or any other outlines maybe not more than 130 pounds test), angling spears, spear weapons, spear information, critical handle, fishing supplies and you may precious jewelry, and you can any bits otherwise jewellery sold on or even in exposure to these blogs. Add the tax on each product sales inside one-fourth and you can enter the full on the line for Irs Zero. 41.

Sealaska Aids Sitka Tribe Efforts to protect Herring Fishery

Once they want additional withholding, they must fill in an alternative Form W-4 and you can, if required, shell out estimated income tax from the processing Mode 1040-Parece otherwise by simply making a digital payment away from estimated fees. Team who found info might provide financing on their workplace to have withholding on the information; discover Gathering taxes to your information inside the part 6. When you have a fair reason behind perhaps not managing a worker since the an employee, you’re treated of having to pay work taxation to have you to staff. Discover so it relief, you ought to document all required government tax returns, in addition to information production, for the a factor in keeping with the therapy of the brand new employee. Your (or the ancestor) cannot has treated people staff carrying a considerably comparable reputation while the a member of staff the symptoms beginning immediately after 1977. Get hold of your regional income tax company to own information about tax withholding..